The November 1 release of the EIA Petroleum Status report estimated crude oil inventories fell In the US by -2.4 million barrels. Compared to last week’s meager inventory gain of .09 million barrels, trade has responded more in kind with the bulls, as crude demand remains consistent since US refineries have been brought back online. Refineries were reported at 88.1 percent of their estimated operable capacity, which is up .03 percent from last week. Gasoline inventories were also reported to have seen a -4.0 million barrel draw down and seeing as refineries still have room to ramp up production, demand for WTI should continue into the near future.

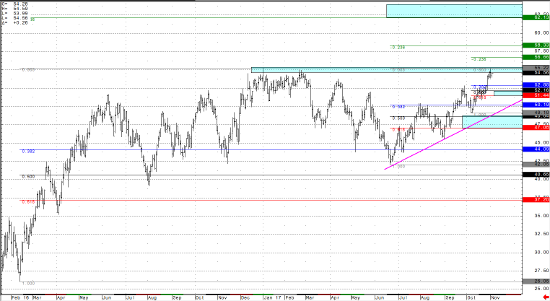

From a technical perspective, WTI crude oil futures have continued to trend higher from the mid-summer lows in the continuous contract. Below I have included a daily bar chart, outlining some of the important price levels that could produce a reaction in the crude market. The most important of which, is the 55.22 high from December of 2016 and gain the 55.00 handle highs from January of 2017 (which also happen to be the highs of the year 2017 and 2016). This 55.00 area has acted as resistance for several years now, and while it is holding until it doesn’t, its producing a short term barrier for the bulls. A trend line that can be drawn against the lows should produce support on a pullback into the 51.44 area, and the 50% pullback of the most recent rally comes in at 52.16. Below those levels, a larger 50% retracement can be found at 48.64, and I would anticipate support zone to be found there. Above the 55.00 handle, Fibonacci projections could take the market to the 62.00 area, which is a high probability target if this move continues higher.

In my opinion, crude oil futures are at a short term line in the sand, where a breakout higher could be imminent. I am cautiously optimistic that the 55.00 area will give way to a rally higher, however, the closer the market gets to to 60.00 per barrel, the higher probability more oil wells and rigs will be brought online (if they aren’t already) to meet demand. With global production nowhere near its full capacity, the price of WTI oil likely remains capped in the near term (where that level is however, remains the battle).

Crude Light Daily Continuation Chart