On the long end of the yield curve, the 30-year bond future presents an interesting case study for risk on versus risk off trading amid a number of technical and fundamental factors.

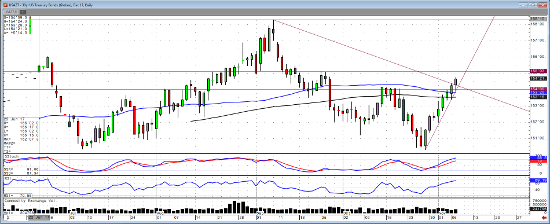

For instance, while nothing is ever certain, Fed Funds futures have priced in a rate hike in December as a near certainty on the other end of the yield curve. While a rising rate environment is typically bearish for interest products, we have seen the 30-year bond rising, making higher lows from the October 27 low. Trade from this low has also breached above the trend line from the September 7 high and also surpasses what some would consider a sloppy double top in mid-October, as well as the 154 level which acted as a support in September and resistance for most of last month.

Add in the factors of recent geopolitical tension, especially in the Middle East and stock markets which are regularly making all-time highs, it would seem that something has to give soon. Continued higher lows could lead to testing the September 7 high, although it is easy to see range bound trade at these levels, or a reversal should the trend from October 27’s low reverse.

30 Year Treasury 240 min Chart

30 Year Treasury Daily Chart