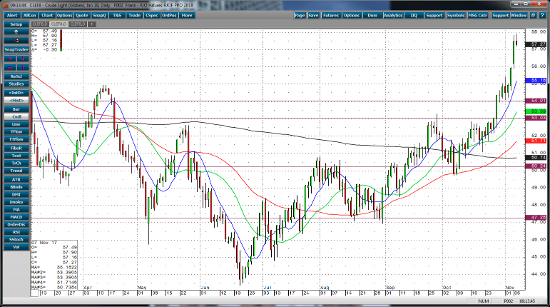

Crude oil futures prices have added an additional $3.90 of premium over the past two weeks since the technical breakout above $53.00. Once the January contract broke out above $53.00, it triggered more aggressive buying as traders raced to cover their short positions. Perhaps that was just the Saudis juicing up crude oil premiums as they attempt to take Aramco public? They do have the muscle to trigger that type of buying, it was just a matter of getting the futures price to pop over $53.00. Then on top of that, we get hit with a government crackdown and shakeup in Saudi Arabia to spike prices another $2.00 to start trading on Sunday evening into Monday. Now, we all know that a real bull market needs a steady diet of bullish fundamentals to sustain a rally. I think that the shock of the government shakeup is already fading and that the real supply side fundamental will return to the forefront. A natural retracement back to the breakout level at $53.00 is all I would expect at this time. We have to see how other news develops in terms of geo-politics, but barring any unforeseen event we should see prices dip back towards the $52.00 to $53.00 trading range.

Jan ’17 Crude Light Daily Chart