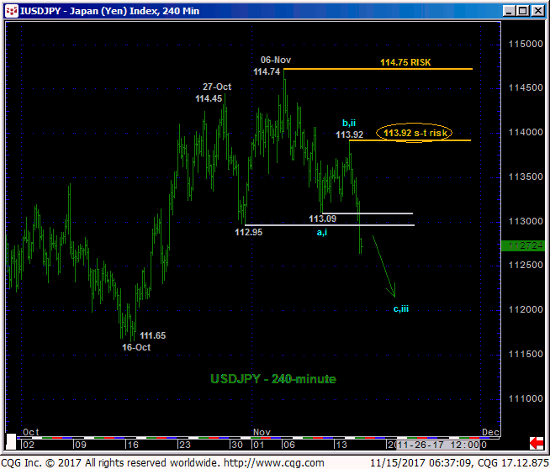

The market’s failure overnight below not only 09-Nov’s 113.09 initial counter-trend low but also 31-Oct’s 112.95 corrective low confirms a bearish divergence in daily momentum (below). Especially stemming from the extreme upper recesses of the past six months’ 107 – 114-50-area range, this momentum failure raises the odds that 06-Nov’s 114.74 high COMPLETED the uptrend from 08-sep’s 107.31 low and that the market is prepping for a larger-degree, if intra-6-month-range correction or reversal lower. In this regard we are considering 114.75 as our new key risk parameter to a new cautious bearish policy.

Today’s resumed weakness leaves yesterday’s 113.92 high in its wake as the latest smaller-degree corrective high this market is now minimally required to recoup to negate a more immediate bearish count. Per such 113.92 is considered our new short-term risk parameter from which a cautious bearish policy can be objectively based and managed. Former 112.95-to-13.10-area support is considered new near-term resistance.

Contributing further to a call for JPY strength and USD weakness is the return to a historically low/bearish 20% reading in our RJO Bullish Sentiment Index of the hot Managed Money JPY positions reportable to the CFTC shown in the weekly chart above. Reflecting just 39K JYP longs to a whopping 154K shorts, there is ample fuel for JPY strength following today’s bearish divergence in USDJPY momentum that, in fact, breaks the past couple months’ uptrend.

While we discussed the market’s rejection of the past six months’ upper boundary resistance, both the weekly (above) and monthly (below) charts show this market still deep, deep within the middle-half bowels of the past couple YEARS’ range where longer-term direction remains nothing short of a coin flip. Also, the odds of aimless whipsaw risk remain high under these conditions, so a more conservative approach to risk assumption remains warranted.

These issues considered, traders are advised to move to a cautious bearish policy and exposure from 113.00 OB with a recovery above 113.92 required to threaten this call enough to warrant its cover. In lieu of at least such 113.92+ strength further and possibly more extensive, if intra-range losses should not surprise straight away.