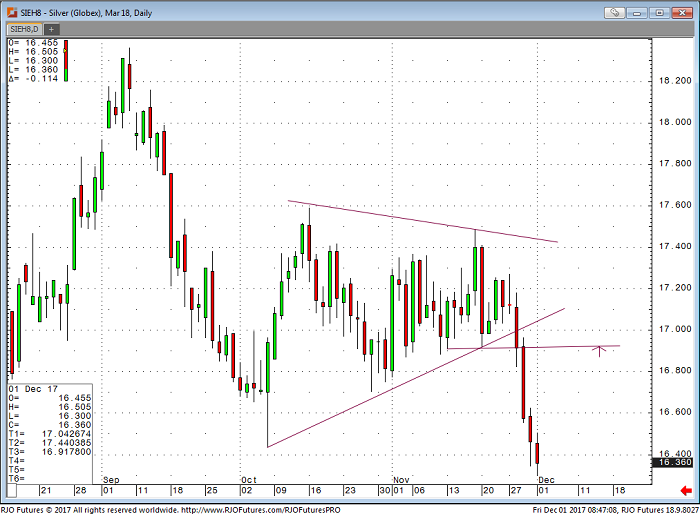

March silver is trading 16.355 down about 11 cents on the day. The chart below shows breakout outside of tight consolidation. Bulls failed to keep up momentum and leave the bears totally in charge of Silver. The only argument the bulls can make is probably a retest of 17.00 level as indicated below. As the probability of passage of tax bill goes up, risk type of trade is taking a back seat. Other matters to consider is also the rise of Cryptocurrencies that are attracting more attention than the metals as a means of diversification. Regulators are giving the green light to Crypto’s resulting in other options to hedge.

As always, on a nice price break like this one, Bulls can wait and see for the price to firm up to go long. Bargain hunters can ease into the long side from these levels with a tight risk. As I have stated before, those who want to be long silver will be better off if they come in on strength rather than weakness. That said, a close above 17.05 should provide that, near-term lows are possibly in. The March contract of silver is trading around 17.200 at this time.

Silver Mar ’18 Daily Chart