While many believe that May coffee prices are oversold, we have yet to see any solid bullish supply news to reverse this falling market. The best a coffee bull can hope for is dry weather in major growing areas, a weakening Brazilian currency which hasn’t yet happened, or as The Hightower Group has reported “fresh signs of lower than expected output from the upcoming Brazilian and/or Vietnamese crop.”

In addition, we need to consider the fact that the U.S. dollar is still holding support above the 9600 level and remains in an uptrend, adding selling pressure many of the worlds commodity prices.

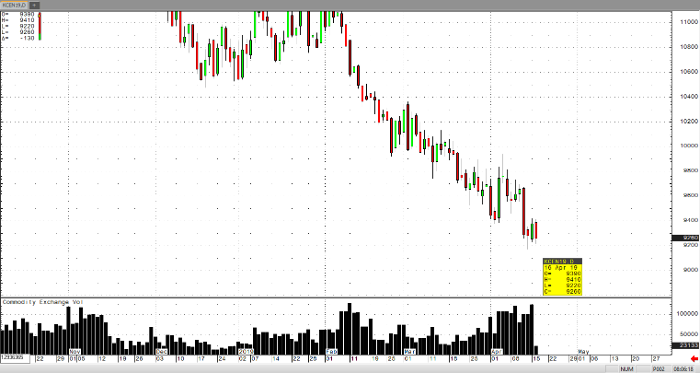

Volume levels continue to remain high while the selloff in May coffee prices continues, showing now real divergence. A convincing dive below the 100 level in March saw a strong return move subsequently, and shortly thereafter another leg down was made. In my last article I pointed out that “a challenge of the 9100 level is on the horizon (both yesterday and today), and we will likely see a violation of this area.”

Coffee May ’19 Daily Chart