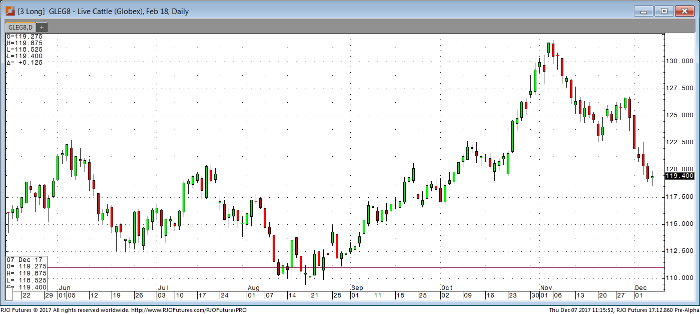

February live cattle is already down 9.6% from the November 6th reversal top and leaves the market in a short-term oversold condition. The market is however absorbing a hefty supply of market-ready cattle and if consumer demand for higher-priced beef cuts slows once the holiday demand is booked, the cash market could remain in a downtrend. The 5-day forecast is still bone dry for the central and southern plains and the 6-10 and 8-14 day models show below normal precipitation and normal to above normal temperatures. This weather outlook is bearish for the cattle market.

Overall, the short-term trend remains down and the market is vulnerable to further long liquidation selling. The short-term supply outlook is bearish but the market is approaching oversold status. February cattle resistance is at 120.70 and 121.50, with 118.07 as next target.

Live Cattle Feb ’18 Daily Chart