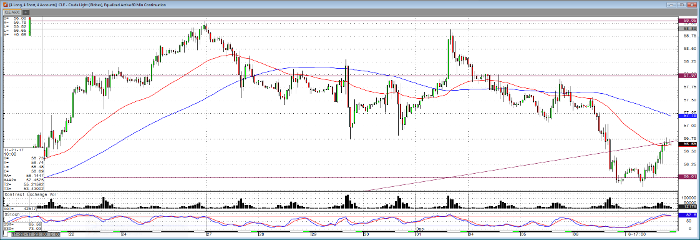

As of Thursday afternoon’s trading, oil has rebounded from the mid-week dip it experienced testing the $56 per barrel level before recovering. This could mark a return to range bound trading for oil, as seen (for the most part) around this time last year up until March. Many believe that OPEC does not want to see the price above $60 a barrel due to the profitability of shale production (and refineries) at this level. That being said, and explaining one side of the charts, OPEC still wants to have as high of a price of oil as possible without adding to competition.

Traders also will keep noting whether the current OPEC quota, recently extended, will continue to be met with compliance. Wednesday’s American Petroleum Institute number saw a draw in inventories for the first week of December of 5.6 million barrels.

For those looking ahead, many will monitor tomorrow’s US employment number as well as rig counts. Any surprises on these numbers and, of course, geopolitically, such as in the middle east or on U.S. tax changes could add to volatility.

To discuss how our desk is currently positioning in the oil market via calendar spreads as well as with options, or to discuss any of your trading needs, please contact me at your convenience.

Crude Oil 60min Chart