The Global equity markets were generally weaker Wednesday night with the RTS index and the Hang Seng markets bucking the trend with gains. The bulls remain in control into the start of another trading session as the passing of the long feared FOMC meeting looks to encourage the bull camp. In fact, given that the Fed seemed to lower the number of projected rate hikes next year from four to three that seems to renew the hope for low rates for a moderate period of time ahead and that clearly is a good environment for equities. As indicated already, the path of least resistance in the mini S&P looks to remain up with the hope of tax reform keeping a positive influence on the market. Buying support in the March E-mini S&P today is seen at 266325 and initial resistance is seen up at the old high of 267550. Prior to the Fed meeting, positive data might have been seen as a negative for equities, but now that the rate hike is reality, stocks might prefer to see better data and with this morning’s claims expected to notch higher that could result in a modest corrective dip early on.

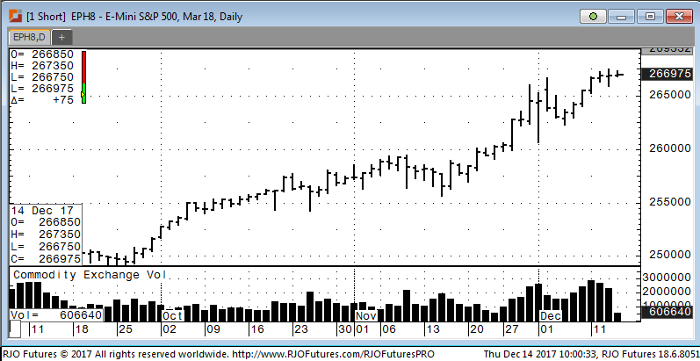

E-mini S&P 500 Mar ’18 Daily Chart