As 2018 begins, it is interesting to note the effects of numerous markets on others and how these will certainly affect each other in the upcoming year.

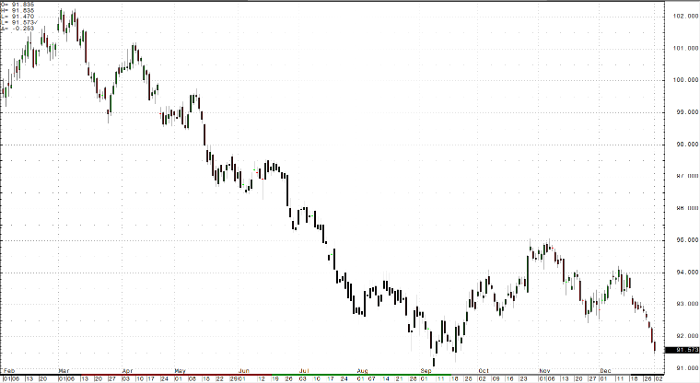

Beginning with interest rates and currencies, many have noted the lack of appreciation in the USD. While a number of rate hikes are forecast for the upcoming year which would fundamentally support a stronger currency for those looking to carry trade pairing the USD with a currency with a lower interest rate; the risk on and global growth mentalities which abound have led to a lack of demand for USD as traders and investors are focused on participating in the appreciating stock and commodity markets.

Commodities and stocks priced in USD have done well as have a number of metals and energies. While weather may be attributed to recent moves in energies such as natural gas and heating oil, there are a number of other factors such as turmoil in Iran and Saudi Arabia, refining, production and inventory strains post hurricane and pipeline outages amid increased demand prospects. This can also be seen as affecting other currency markets for countries which are heavily linked to commodities, such as the Canadian Dollar and Australian Dollar.

While these are a few commonly discussed inter-market relationships, there are numerous others monitored by market participants on a daily basis. Some examples include:

- Spread trading among numerous currencies

- Calendar spreads among different crop expirations pre and post-harvest in grain and agricultural markets

- Spreads within the same market sector such as oil and gasoline or different maturities on the yield curve

- Spreads between different listings of similar products such as oil, metal and grain contracts on different exchanges for the same or similar commodities

These are just a few of many, many examples. To discuss how various markets interact with each other and how to participate in your trading, please contact me at your convenience.

US Dollar Index Daily Chart