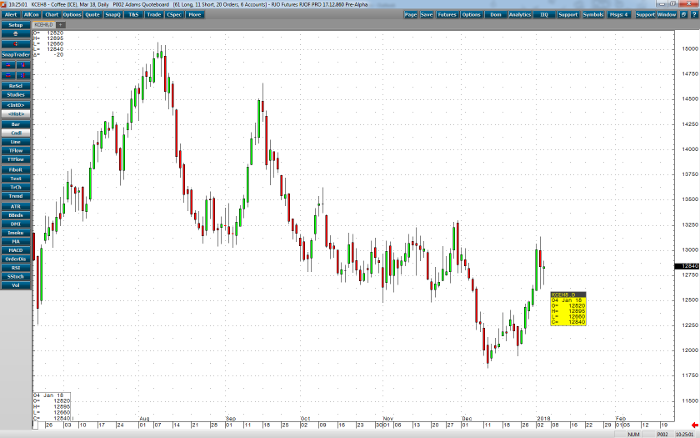

The intermediate trend in coffee has been up, likely supported by a weak US dollar, strong Brazilian Real, and a strong crude market. Spotty rains throughout Vietnam, weighed against solid production numbers from Columbia, should have March coffee prices consolidating in a game of tug of war for a while. The 132 – 125 range is no stranger to coffee prices, as they remained in this range from October through December of last year. I would expect to see quite a bit more consolidation but closely monitor the upside 132 level for any potential breakout, as coffee prices need very little fresh fundamental news to revisit the highs from last year.

Coffee Mar ’18 Daily Chart