This week was full of data and developments in the oil markets with Thursday’s EIA Petroleum Status Report, the announcement of drilling leases in the Atlantic, Pacific and Arctic as well as Friday’s Jobs number.

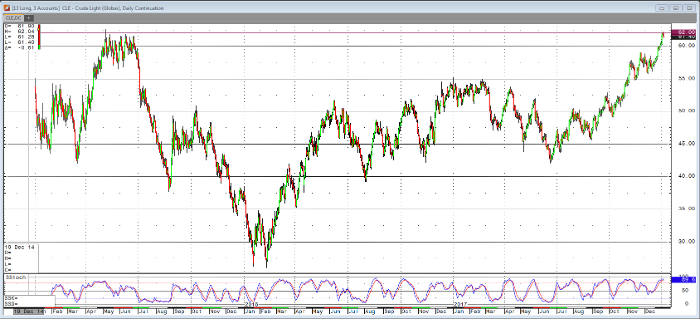

The EIA report showed crude oil inventories falling 7.4 million barrels in yet another draw, leading oil to trade above $62/barrel for the first time since May 2015. This was then followed by the reports of leases for offshore drilling in the United States being expanded to the largest level ever. Since then oil prices have paused with little effect from the jobs number after its release earlier this morning.

For many, these levels not seen in some time for crude oil are a time to monitor the market closely. Traders have also noted spreads between front and further out calendar months and between Brent and WTI crude affected by this week’s developments.

Technically, while traders will note the $62/barrel level, many may also note a potential key reversal on the daily timeframe. While trading to the downside as of Friday morning as of this writing may be long profit taking or flattening prior to the weekend, if continued could mean something more. That is not to say that for the time being, oil continues to be demanded, drawn out of inventory and bid.

To discuss your oil trading and different ways to trade recent price action, such as through futures, option on futures, calendar spreads, inter-market spreads, please contact us at your convenience.

Crude Oil Daily Continuation Chart