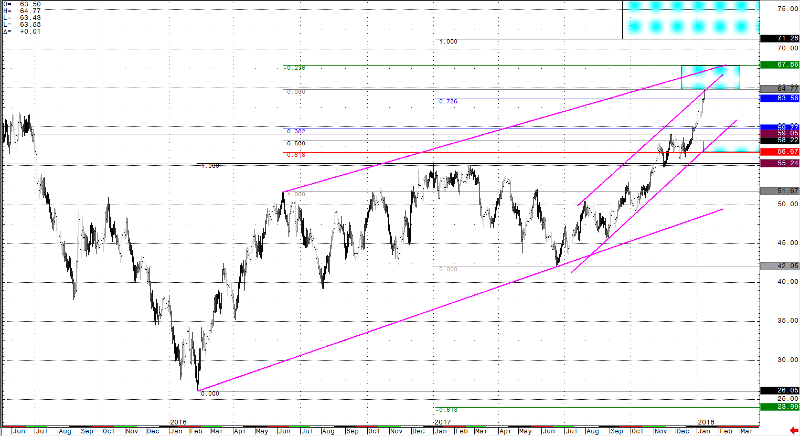

This week, WTI crude oil futures took off above the $60.00 threshold that has formed a considerable barrier (resistance) which has capped the price of WTI crude for the past few years. With the price of WTI crude futures now breaking above resistance, traders should expect tests of broken resistance (now as support), and to look for signs of a broader trend reversal being underway. Fundamentally speaking, there is still a perfect storm for crude prices which is causing a short term supply crunch. With OPEC nations sticking to the cuts in which they agreed upon, and the Keystone Pipeline still running at reduced capacity, the WTI crude futures curve prices became inverted (backwardation began). This occurs when front month contracts are bid up, as consumers need the oil now they are afraid they will pay more for (or won’t be there) in the future. This concept is how a fundamental supply crunch is priced across the serial months of most commodities futures curve. The cherry on top of this black-gold sundae, is the consumption from gasoline production (and the uptick on the Kushing pipelines draw). This week’s EIA petroleum status report cited yet another drawdown in inventories, with crude stockpiles in the US dropping by -4.9 million barrels (and after last week’s impressive reading of -7.9 million barrels).

While the fundamental picture looks bleak for the bears, with crude consumption consistent, and inventories needing to be replenished, the technical picture may be calling for a short term pullback. I personally see this event as more profit taking from the bulls, than a reason to be a net seller and try to pick a top. In my last article, I discussed the various support levels that were proving the bulls’ consensus, and could take us to the 62.00 to 64.000 area for upside bull targets. The market has inevitably proven the bulls’ case, and while I am still optimistic about continuation higher, it may be time for a test of broken resistance (old) now as support (new). The Fibonacci support zone that begins at 58.22 is the first logical area of major support (below the obvious psychological support of the 60.00 handle). I consider this last leg up in crude oil futures (from June of last year) still underway while above 56.60. The ball is now in the bulls’ court, and it’s theirs to loose.

Crude Oil Daily Continuation Chart