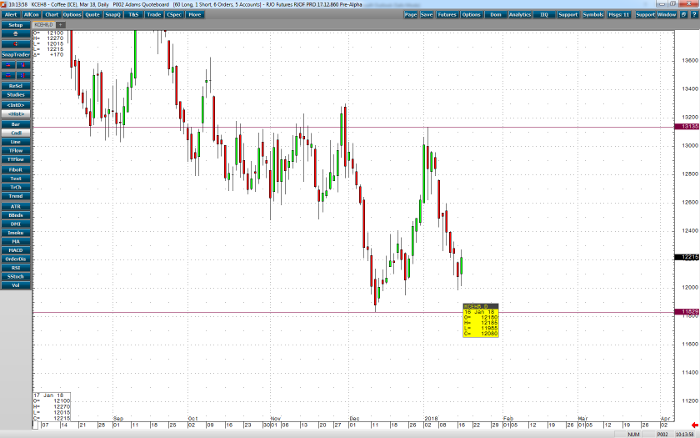

The fundamentals of the coffee market have been overwhelmingly bearish, evidenced by the consecutive seven days in the red, and kicked off by a large gap-down open on January 8. Most of the selloff seems to be related to the large crop outlook for that largest, and second largest producers of coffee in the world. The Hightower Group has recently reported that both “Brazil and Vietnam continue to weight on the market”. This, along with reported falling exports in Brazil will likely provide this already struggling market with continued bearish sentiment. Technically, coffee prices failed to challenge the 13135 level which had been good resistance. Even more importantly, support was not found at the 126 level, which had been a solid and formidable support for a while. It’s likely we will continue to see falling prices in March coffee, as nothing of any significant fundamental support exists at this time.

Coffee Mar ’18 Daily Chart