As of Thursday afternoon’s trading, the March 2018 oil contract has seemed to pause within its appreciation which began in June and recently marked a 3-year high. What makes this most interesting is that Thursday’s downward price action comes after a number of fundamental bullish factors, such as:

- delayed Energy Information Administration number which showed a larger than expected draw in inventories

- the return to production for a number of shale producers and corresponding estimates on output

- record longs in the commitment of traders

Perhaps the pause in buying may be attributed to OPEC being quoted through their monthly report stating “Higher oil prices are bringing more supply to the market, particularly in North America”. The same report also notes growth in supply in the US, substantially more than in the recent past.

Going forward, traders will be eyeing if the continued growth in shale production and supply leads to further selling or if new highs are tested amid global growth and demand.

Also, spread traders will note the front month contract bidding oil out of storage as it trades at a premium compared to further out expirations.

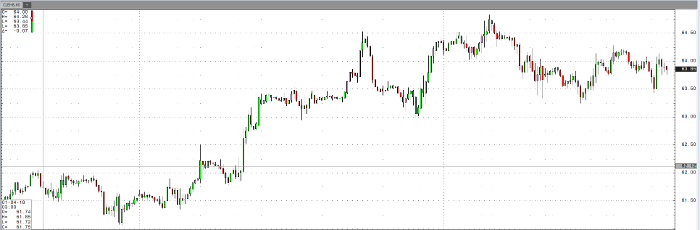

Crude Oil Mar ’18 Daily Chart

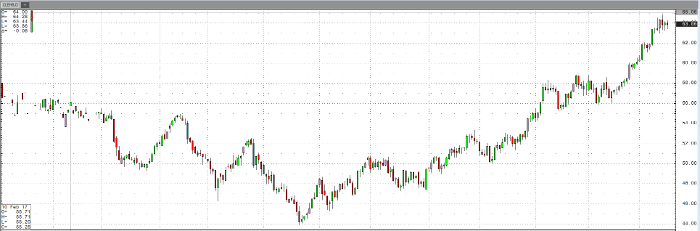

Crude Oil Mar ’18 60 min Chart