After disappointing data from last week’s grinding info, March cocoa futures have consolidated. Asian grindings missed their mark; North American data continued on a negative path. Currencies are attempting to provide support for cocoa. A slipping dollar, a rally in the pound and a strong move higher in the euro may be what is needed to get the March contract back above 2000.

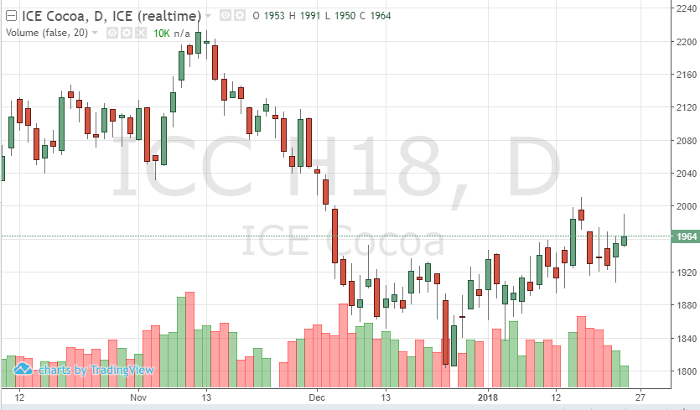

Technically, 1925 had been support – 1950 is the near-term support and 1995 is resistance. Although we are in a consolidated channel, the move is slowly moving higher.

Barry Callebaut’s quarterly results showed an 8% sales growth – this is well above expectations and can help the demand outlook in cocoa.

Closely monitor demand data from North America and Europe in the short-term to see if the technicals can get some support and assistance from global demand – these two moving pieces can help get futures prices back to the 2100 range as contracts will begin to move from March to May next month.

Cocoa Mar ’18 Daily chart