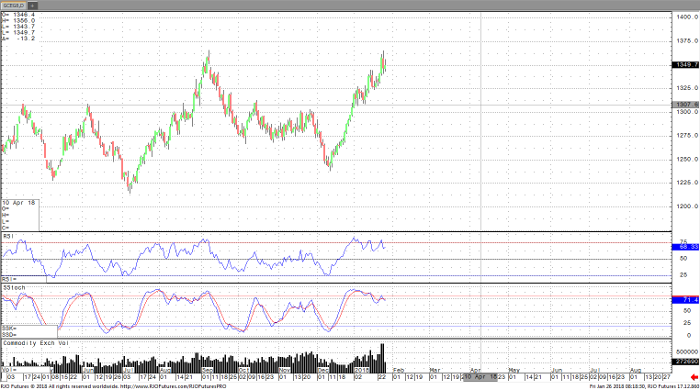

February gold futures have seen a significant pullback off the high’s on a recent bounce in the US dollar. We have seen a number of reasons for the continued bullish trend in gold. The first and most obvious reason for a push above $1,350 were remarks from US Treasury Secretary Steven Mnuchin’s welcoming of a weaker US dollar. A weaker US dollar, all things being equal, boost commodity prices across the board. It helps US origin commodities become cheaper to purchase and keeps us competitive in the world. Another fundamental reason for the push higher has been talk of inflation occurring should the economy remain as strong as it is. The real driver of this rally should not be overthought; it’s off of a very weak US dollar. There is some talk of a potential “trade war” with China or another country, but I believe this will not occur. China is too important to us at the moment, with the most obvious being keeping China on board for North Korea sanctions. February gold futures today have in fact bounced near the $1,340 level on weaker US GDP data coming in at 2.6% vs 3.0% expected.

The technicals on gold remain friendly. We approached overbought conditions, however, this recent pullback has helped build a case for another leg higher. Any dip in the market needs to be bought into. Look for strong support account $1,340 and a breakout above $1,366 will signal a breakout and potential run to $1,400.

Gold Feb ’18 Daily Chart