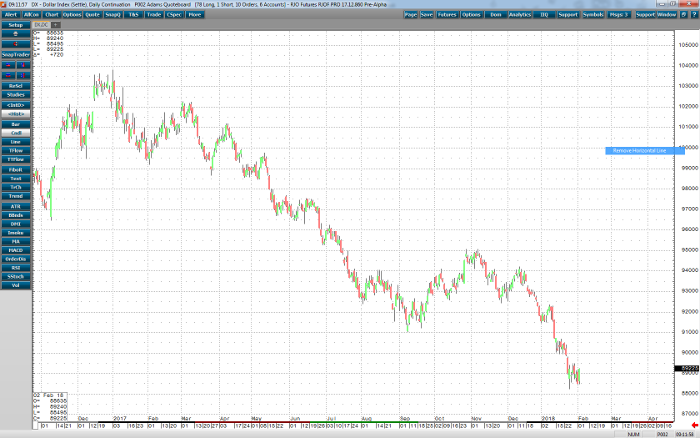

The dollar index had its worst January since 1987, down 3 percent and going through several wild price swings.With the dollar index trading below the 90 mark, near levels last seen in 2014, we’ve had several conflicting political messages and economic data that have really launched a two-sided trading affair that I’m watching closely here.

Treasury Secretary Steve Mnuchin commented last week that he is not too concerned about a weak U.S. dollar, then said one day later that a stronger dollar is in the best interest of the country. President Donald Trump, meanwhile, reiterated that he ultimately wants to see a stronger dollar relative to foreign currencies. At the same time, economic data for the first quarter of 2018 should reflect strong quarter-over-quarter growth, which should theoretically boost the value of the dollar.

The long-term picture

While a 3 percent decline since the beginning of the year doesn’t sound ll that bad, the bigger picture speaks to the true weakness we have seen for the greenback. The dollar index has tumbled 11 percent in the course of the last year and has played a part in boosting commodities across the board like palladium and lumber.

US Dollar Index Daily Chart