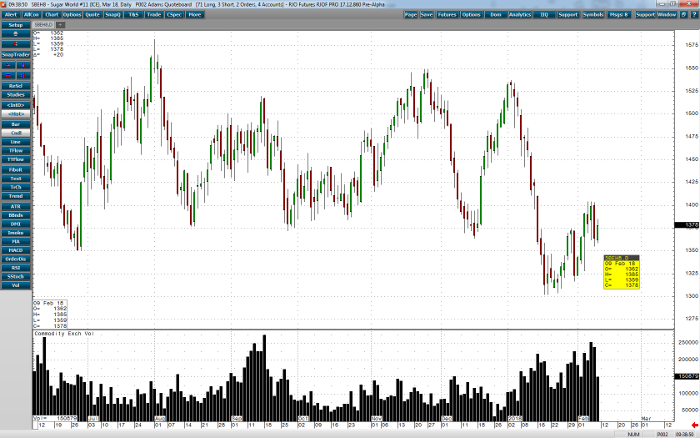

This week’s comment finds a sugar market consolidating and switching between wire service reports of large supply and large fund short position. The ‘risk off’ mentality and severe testing of trend followers, as outside markets react to the 10% correction underway in the stock market, may ironically be good for the March sugar futures. The large short position held by commodity fund traders could be cannibalized as risk managers help traders under duress find profitable positions to offset in order to fund positions that are underwater. The Hightower group has done a great job of highlighting the possibility that South American producers could continue to shift from sugar to ethanol thereby reducing the supply of exportable sugar from one of the largest producing regions of the globe. This is one bullish fundamental the market has been able to hang a hat on as we have worked higher but has faded as the crude oil market has also come under pressure. The March contract has done a good job of stabilizing and trying to retrace almost half of the recent move to new lows. Still, with the March contract unable to close above the 50-day moving average, currently coming in near 14.17, this places some importance on holding the 18-day moving average, 13.48, at the time of this writing. If the March sugar futures demonstrate an inability to close over the 50 or hold the 18 that would signal the price action from the last two weeks is merely consolidation and new lows are likely.

Sugar Mar ’18 Daily Chart