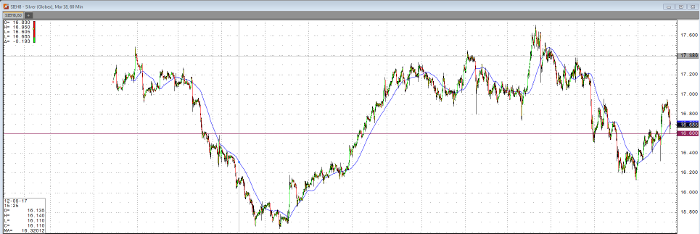

As of Thursday morning’s trade, the March silver contract is trading near the $16.60 level, which coincides with the two hourly bottoms on the second and sixth of this month as well as hourly tops from Tuesday. One may also note the significant downward price action from this level in late November and rise above this level from the day after Christmas up until the January 25 high.

Should this level hold, the February 9 lows may put in a short-term bottom, especially amid yesterday’s CPI report with a 0.5% month over month increase. Today’s PPI report also showed inflation near the top range of expectations at 0.4% month over month and 2.7% year over year, 0.1% above the 2.6% consensus estimate. While inflation is typically bullish for metals, the forecasted increase in yields, which metals do not pay, should be considered as well. This is especially so given the 10-year yield reaching a four year high of 2.92%. Of course, dollar weakness and strength should be monitored as well given their effect on commodities and metals prices.

Going forward, silver traders and the market as a whole will continue to monitor such inflationary pressures as well as the dollar, Fed speak and the like.

Silver May ’18 60min Chart