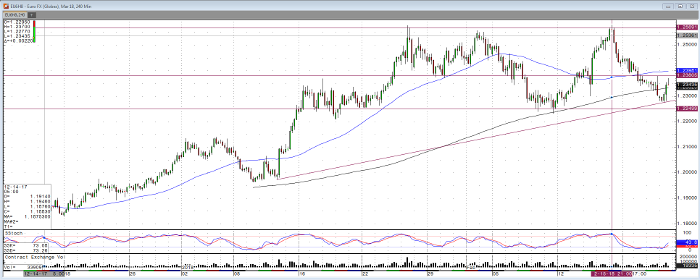

As of Thursday morning, the March ‘18 Euro contract continues to trade near the trendline intersections from the February 15 island reversal and the higher lows from the longer term uptrend. The market also has the potential to be range bound ahead of a good amount of news next week and a current price between the 200 and 50 period averages (240 minute).

While yesterday’s FOMC minutes were somewhat hawkish considering the bond markets’ reaction and giving strength to the dollar and hence, some weakness for the Euro, the European readings of the last 36 hours also have not been positive for the continent. Looking ahead, German coalition and Italian election results also present possible uncertainty ahead of their March 4 outcomes. For options traders or those looking for efficiencies in margin and premium with a lack of time built into premiums, this date marks five days prior to the March contract options expiration date of March 9.

Between now and then, the European and US economies will see a number of economic updates released traders should be mindful of and monitoring closely. While these updates and outcomes could complicate existing positions, they may also present catalysts for those looking to adjust existing positions or enter new ones.

For a free consultation regarding your trading, in these markets and products, as well as others offered, please contact me at your convenience.

Euro Mar ’18 240min Chart