The FOMC minutes that came out on Wednesday afternoon were initially interpreted as dovish which sent the stock market soaring to new session highs, with the March S&P futures hitting 2747.75. However, within the hour the Treasury bond market began to plummet with the 30yr Bond leading the way. This in turn sent the S&P reversing hard as the market is very sensitive to the idea of higher interest rates. This is a relationship worth keeping an eye on, as the stock market has had a historical rally on the shoulders of low interest rates and stimulus. Those two ingredients are coming out of the batter, and it’s yet to be seen if the market can adjust.

There were mixed messages in the minutes, which led to the wild intraday swings. On the one hand the Fed didn’t raise rates, and mentioned that they would stick to gradual rate hikes. On the other hand, the Fed stated that there were “upside risks” to economic growth. They also mentioned that inflation was picking up and the 2% target rate would likely be realized in the “medium term.” The Fed stated that the CPI would rise “notably faster in 2018.” As mentioned in the last article, inflationary gauges are worth watching closely. The Fed’s main task is to keep a lid on inflation, and historically when the genie is out of the bottle it is a race to put it back in. A rapid increase in interest rates are not favorable in general to equities.

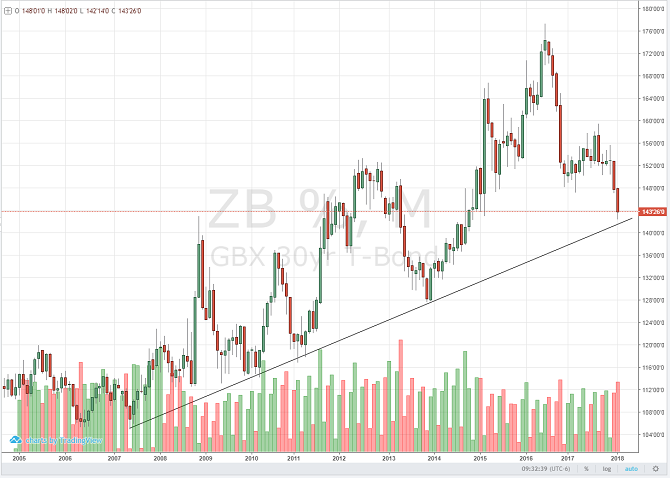

Moving forward, the Fed is expected to raise rates at the next meeting in March, and two more times after that in 2018. There has been talk of a possible fourth rate hike, but that largely depends on the trajectory of the economy and inflation. The 30yr Treasury is trending down and has now reached a major 10yr trendline on the monthly chart. This 10yr rally coincided with Quantitative easing, and now has fallen down to the trendline as the Fed has halted asset purchases and begun to unwind its balance sheet. There could be technical support at these levels in the low 140 handle on the 30yr futures contract so shorts should be cautious. However, rallies should be sold, and in my estimation the 147-148 area should be a sweet spot of resistance. For any help on technical levels, or interest rate strategy, feel free to contact me directly.

T-Bond Jun ’18 Daily Chart