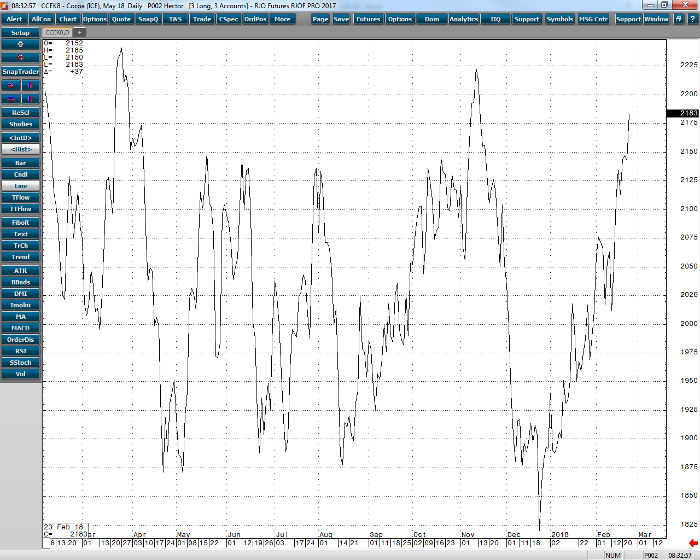

The cocoa market has put a great fear on those who have been long the last few weeks as yesterdays close was less than desirable. Those who have been long have been waiting for a breakout and settlement above 2200. As we come to the close of the week I am skeptical that the market has the strength to make the run. This morning we are trading about 30 points higher on the idea that cocoa demand is still going to outpace the global surpluses we have seen the last couple of years. Granted, we will not have solid numbers on paper until the next set of grinding numbers come out in April. However, even if today’s trade does push above 2200 we still need a good solid close above that level in the May contract to keep the long position holders satisfied. Current resistant levels are at 2180, 2200, and at 2223. A close above 2200 will be the first since November of last year and a likely sign that we may have finally beat the range that we have been in since Thanksgiving of last year.

Cocoa May ’18 Daily Chart