This week we saw the release of the ICCO’s quarterly supply/demand data. The ICCO announced that its global production expectations are down 2.3% and grindings are up 2%. Lower production estimates lead to higher cocoa prices and that is what we have seen of late. The West African dry season has added pressure to production and in turn we have seen a fairly strong bullish rally. Now that supply/demand news has taken center stage, we will look at outside forces to decide how long this rally can take place. Will a stronger dollar add resistance to this recent move higher? Can a recovery in the euro or pound help the demand side of the equation and give the market additional support? These questions will guide the trade as we enter the end of Q1.

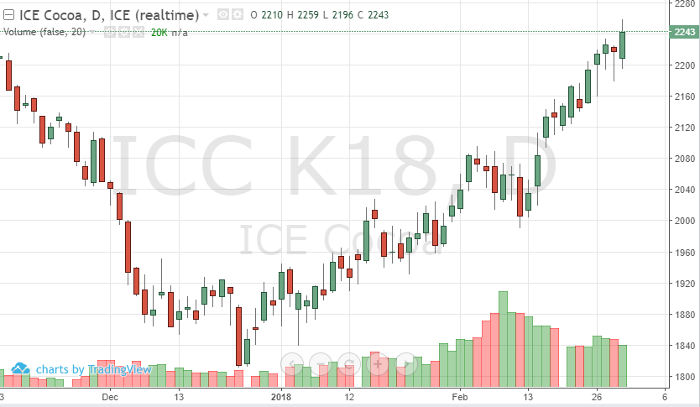

Technically, the wheels are moving in the same direction as the fundamentals. Key levels have been broken, 2185, 2205. Support was found at 2215 and the May contract broke 2250 on Thursday. If the May contract can close above 2250, look for 2285 to be tested. With the recent change in production expectations, boost in demand and technical support – 2300-2400 prices are once again realistic price targets for cocoa in 2018.

Cocoa May ’18 Daily Chart