As of Thursday morning, crude oil was trading at the lowest level in a week following Wednesday’s EIA report. The number showed a build in crude and gasoline inventories in addition to the dollar being somewhat stronger and stock markets monitoring the new Fed chair’s testimony.

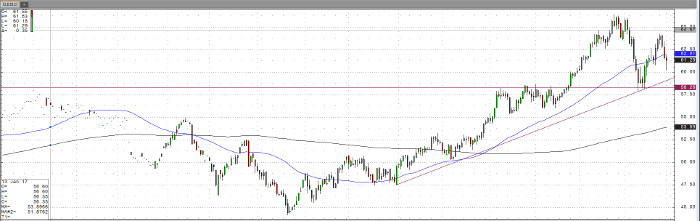

It would seem the market could test the mid-February lows which coincide with the highs of late November and early December in the April contract. While the week has been a good one for the downside, should the price action continue it could lead to some profit taking and offsetting before the weekend as well, given the pace of downward trading Wednesday and Thursday morning. The market did seem to recover from the morning’s low of $60.18 later in the morning.

Moving forward, markets will also be monitoring European election outcomes, interest rate decisions and whether the stock market and global economy are subject to further volatility.

Clients on our desk work with calendar spreads, option spreads and outright future strategies amid such market activity. To discuss how to incorporate such strategies in your portfolio, please contact me at your convenience.

Crude Oil Apr ’18 Daily Chart