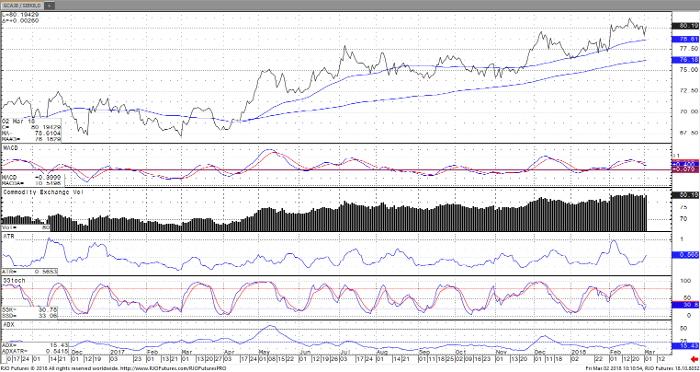

Silver futures continue to baffle the minds of traders with impressive rallies followed by periods of disappointment and head fakes. Its been one of the tougher metals to trade taking its cues from copper and gold. One thing to keep a close eye on is the gold/silver ratio. This ratio measures how many ounces of silver it takes to buy one ounce of gold. Looking over the past two years we can see a steady rise in the ratio indicating that gold has been significantly outperforming silver. Here is the chart of April Gold vs May Silver on a daily basis.

Gold Apr ’18 vs. Silver May ’18 Daily Chart