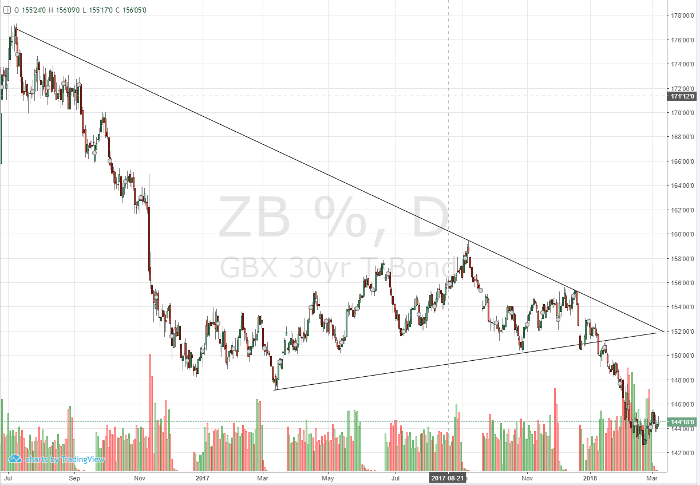

30-yr bonds have been hemmed within a three-point range the past month. That is remarkably tight considering the twelve-point sell-off the bonds sustained over the previous two months. There have been ample reasons for bonds to rally, including equity weakness and heightened volatility, but to this point nothing has offered enough traction to shift momentum to the upside. This could be a telltale sign of a pause and consolidation before a resumption of trend. On the flipside, bonds have had a huge move down since the Fed announced the QE program was over, and a short covering or value bounce would not be surprising. However, as noted in the past several articles, the trend, and the path of least resistance is still down in bonds.

Market heavyweights Bill Gross, Ray Dalio, Jeff Gundlach are all bearish bonds. Whether or not you agree, it is always worthwhile knowing what the biggest players think about your particular market of interest. Even if all the ducks line up in a row for a trade, it is still incumbent upon the trader to find the right timing, leverage, and risk parameters. One can be right about the market, and still lose money if they get one of these variables wrong.

Looking forward practically speaking, the 30-yr bond, as mentioned, is rangebound. It makes sense to continue trading the range with a bias towards the downside. Meaning, look to short the upper end of the range, rather than buying the lower end of the range. This is because bonds are in a downtrend. The upper end of the current range comes in around the 144’16 mark in the June 30-yr futures. Should bonds break out from the range to the upside, we could see a short cover rally up to the 148-150 handle, with 150 being a golden opportunity to reestablish short positions. Depending on profit objectives and risk tolerance, traders can use futures or options, or spreads to establish positions. Feel free to reach out for help fine tuning strategies to fit your particular trading needs.

T-Bonds Daily Chart