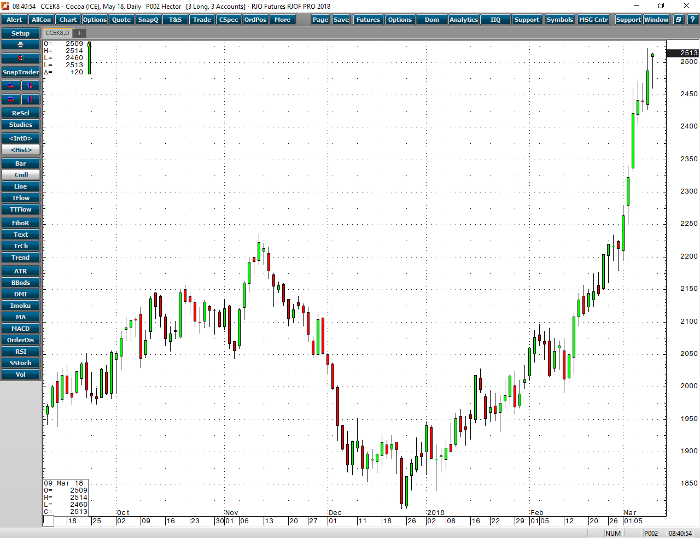

The cocoa futures continue to push higher this week surprising many on just how strong the current trend is pushing prices. However, the biggest question on anyone’s mind is just how long this cocoa market is going to push higher. I would argue that we have already reached a point where the market is going to have trouble pricing in more risk, unless we have more catastrophic news. Currently, we have used catalysts such as hot, dry weather in Ivory Coast cutting production yields, Ivory Coast selling forward more cocoa than it now expects to produce, and finally the scrabble that this news has produced leading to end users paying anything to ensure that they have enough product to keep their production lines running later this year. It is a mad dash for quality cocoa which has given the market over a 400-point bounce over the last 20 days and near 200 points of that was this week. After such a move it is only natural to think that perhaps much of it has been over exaggerated. I would not be so quick to accept that just yet. However, I would start looking at the 2550 to 2600 range on the idea that we may have some profit taking after the market stabilizes.

Cocoa May ’18 Daily Chart