As of Thursday afternoon, April crude oil was trading near $61.30 as the market weighs a number of significant developments and appears to be approaching a crucial point amid relative consolidation for this market.

Wednesday morning’s EIA report showed a large build in inventories of 5 million barrels amid a time of year the refineries are switching their blends. This corresponded with large draws in gasoline and distillates of 6.3 million and 4.4 million barrels, respectively.

While the market took the build as bearish selling off initially Wednesday post report, traders also have considered the decline from the level last year and tightness of compared to years past. We must also consider the historical highs in terms of US production and murmurs that OPEC quota and corresponding compliance may change should their objective be met or from such US production.

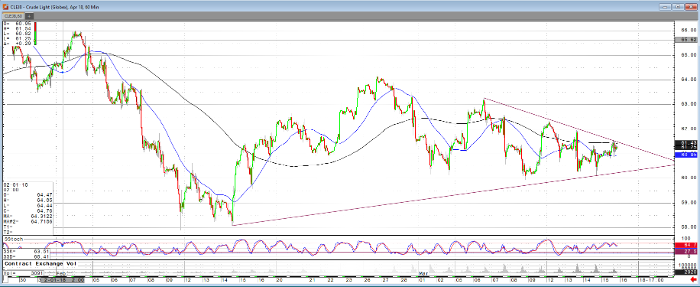

One thing that is for certain is the fact the market has simultaneously traded with higher lows and lower highs for some time now. For some, this may represent coiling price action prior the market finding further direction.

To discuss this setup and ways to position for upcoming trade in your account, please contact me at your convenience.

Crude Oil Apr ’18 60min Chart