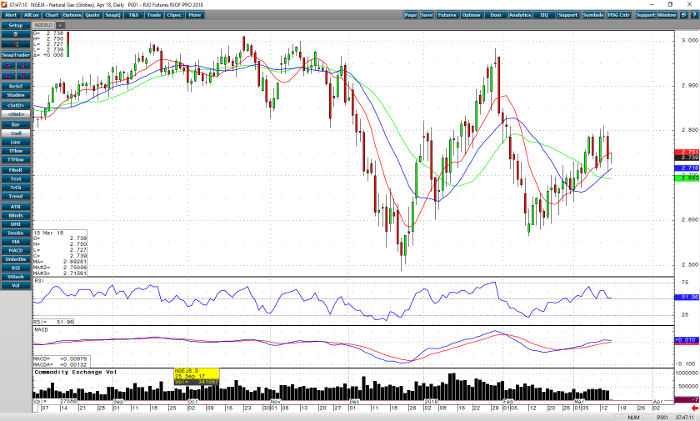

Good morning. The prevailing trend in April natural gas is sideways to up. It has been a steady climb since the low of 2.565 on February 12 to the high of 2.811 on March 13. The 2.800 level is today’s first level of resistance followed by 2.850, and then January’s high of 2.983. Support comes in at around 2.630. Below that there doesn’t seem to be anything technical as support until 2.560. Momentum studies are at mid-levels and are turning up slightly leaving plenty of room for the market to adjust to fundamentals. However, the 2.800 level seems to be one the market is comfortable with.

The weather forecast for the short term is for colder than normal weather in the Eastern United States. The expected draw is -99 bcf, which is pretty much in line with the average. A larger than expected draw may be needed for the gas market to climb above resistance. Continuation of yesterday’s sell off may be in the cards, down into the support numbers in the low 2.600’s. I’m leaning toward the down side today if the storage numbers are close to expectations.

Natural Gas Apr ’18 Daily Chart