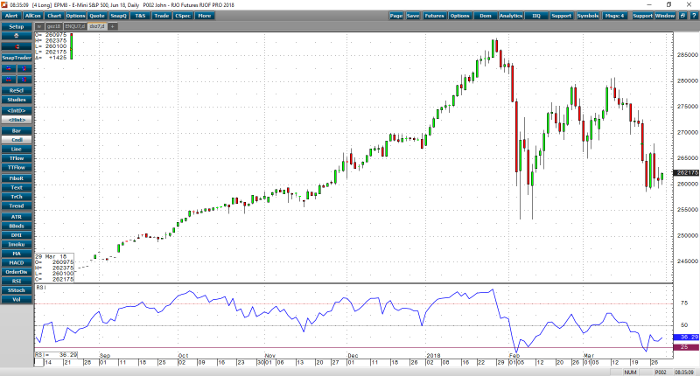

Stocks seemed to have carved out a small measure of support so far this morning. All of the major indices are higher thus far today, after falling a bit short of reaching the lows we saw in February. The E-mini S&P has been bouncing off the 200-day moving average all week, but the rallies have been rather insignificant or swiftly rejected. The Nasdaq and mini Dow have done a better job hovering above theirs, but have also struggled to hold any meaningful moves to the upside. The tech sector seems to have been a dark cloud hanging over the markets with the Facebook data issues, rumors that Trump is looking to take on Amazon, Tesla getting crushed, etc. Whether today’s early bounce is a bit of short covering ahead of the long weekend or traders just looking to take advantage of cheaper pricing remains to be seen. Technically speaking, it appears that the lower levels were at least worth taking a shot at, but it remains to be seen if this rally can actually hold.

E-mini S&P 500 Jun ’18 Daily Chart