This week’s EIA Petroleum Status Report continued to confirm a more bullish fundamental outlook, with crude oil stocks having drawn down -4.6 million barrels for the week of 3/30. The decrease in WTI inventories is likely a result of the increase in refinery operation, with US refineries operating at 93% of full capacity. As I have mentioned in the past, the $60 to $65 price per barrel threshold is significant for many (both within US, and abroad) producers. These two fundamental thresholds, where $66 a barrels “seems pricy” and $59 a barrel “seems cheap”, continues to be the range that has dictated price action for 2018. A move outside this range will likely see a stop-driven follow through, and be the catalyst for a medium term trend. Recent technical levels have also proven supportive for WTI crude, with the market beginning to look more and more constructive to the upside.

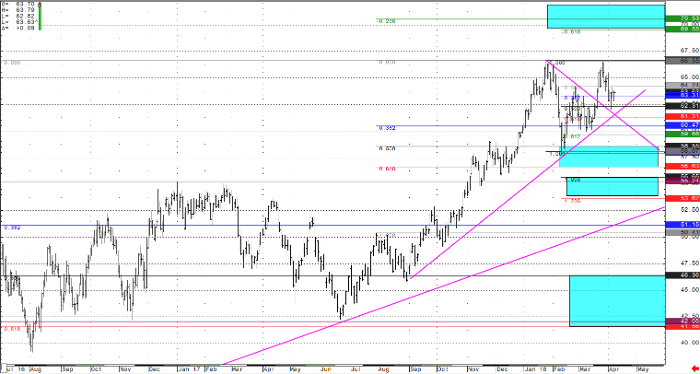

With an increase in oil refining, the rally which broke through trend line resistance (upper magenta line), resulted in a pullback to test this broken technical level (now as support). I mentioned this potentially being the case in my last article, and seeing it now hold (alongside a couple other technical levels) reaffirms my suspicions that bulls are defending their levels. While a Fibonacci support zone has already provided a bounce from the $58.50 to $58.00 inflection zone (blue boxes on chart are Fibonacci inflection zones), WTI crude futures remain firmly below the 2018 (and 2017) contract highs. Upside technical targets form $58.00 could take the WTI crude price to the $68.00 to $70.00 objectives, while near-term support was found at the $62.00 inflection zone. Below the $58.00 inflection zone, are the $54.50 trend line and Fibonacci 100% extension inflection zone, as well as the much larger $46.36 full 50% Fibonacci retracement inflection zone. Either of these supportive areas would be logical downside targets if the price of WTI crude breaks lower, however, the bulls have been holding their key levels and defending their supportive levels. Before this situation can even be considered, WTI crude price would need to settle below $61.00 a barrel.

In my opinion, the rally that took WTI crude prices to the $66.66 continuous contract highs (into the end of 2017 and start of 2018) is still at the forefront of traders’ minds. While there are still the prior highs ($66.66) to break through, there may be an opportunity to position for the resolving push out of the current range. Although WTI crude oil prices remain in a $5.00 range, early indications have begun to confirm that the market wants to continue higher. The market will resolve itself one way or another (on a long enough timeline), and it is up to the trader to define risk and carry their trade to target after confirmation.

Crude Oil Daily Continuation Chart