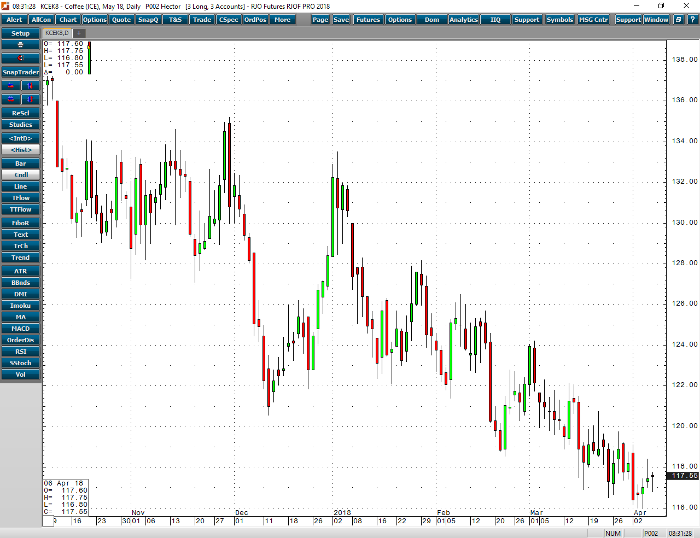

The coffee market woke up this morning slightly lower on a lack of outside news to help give it any direction. This week has given the trade an opportunity to digest the idea that we may be forming a base in the price of coffee. We have been in a solid downtrend for over a year making one feel uneasy about how much further we may have to drop in a market that consistently shows solid demand. I would argue that the trade needs to start looking at the outside markets to give us our next catalyst. The currency factor, which is derived from the US dollar/Brazilian Real Spread, is an important part of how one looks at any of the softs. The idea here is that should economic factors in the next couple of weeks push the value of the dollar lower we can likely expect a rise in the value of coffee. Granted, it should be noted that we have seen that a volatile equities market can sway this theory. However, I would say that should the dollar start trading lower than 89.00 and the equities markets hold steady, the trade might be prime for a solid turnaround in value.

Coffee May ’18 Daily Chart