Overnight equity markets were mostly lower with the DAX, ESTX 50 and the FTSE being the exceptions. It looks as if the equity markets were challenged as a result of fresh Chinese suggestions that they were prepared to handle any negative impacts from the growing trade flap with the United States. Despite general strength in international equity markets overnight, the US markets appear to be poised to start off on a back foot. The US markets have also failed to directly benefit from Amazon’s claim that they have 100,000,000 prime members worldwide. Although the markets this week do not appear to be concerned about rising commodity prices that issue could become front and center today if that situation is noted by any fed members. The June E-mini S&P has traded in a very tight trading range over the past 36 hours and would appear to have lost some upside momentum in the process. Some will suggest that negative corporate headlines from Exxon, Facebook, Southwest and GM, have served to lighten investor interests. Support comes in at 2700 and resistance comes at 2725.

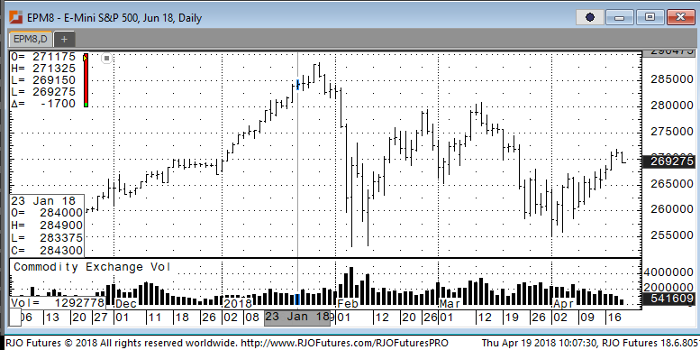

E-mini S&P 500 Jun ’18 Daily Chart