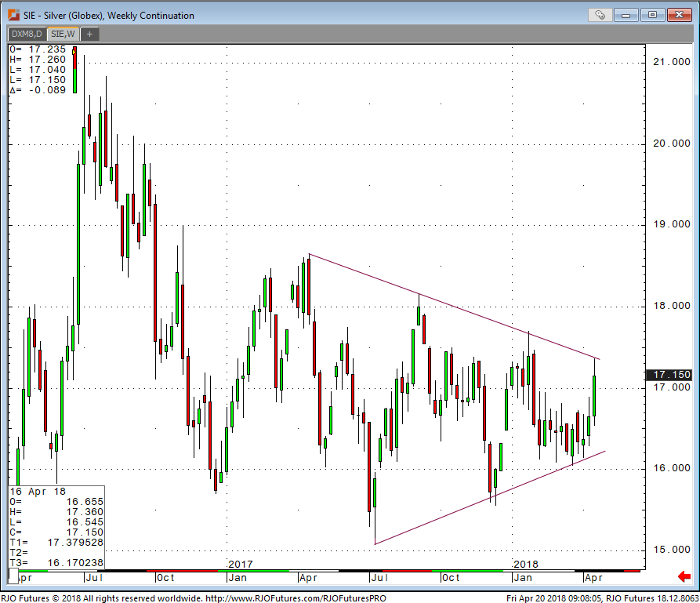

May silver is trading at 17.235, down about 9 cents on the day. So far silver is up about .50 cents compared to last week. The dollar index is strong this morning as it is making a weekly high above 90.00 and that is putting pressure on silver and other metals in general. The technical outlook for the US dollar index is improving with more US rate hikes on the horizon. Even with the strength of the US dollar index, the silver chart looks more bullish with a weekly structure leaving 16.05 near-term bottom. The only negative for silver is the size of longs in this market; therefore, any profit taking type of sustain pullback should be an opportunity to buy rather than sell. My last report, I mentioned that “technically, a close above 17.00 is needed to confirm the downtrend has come to an end.” A weekly close above 17.00 and breakout above 17.50 needed to turn momentum higher. A weekly close below 16.00 will probably end this uptrend.

A weekly close above 17.50 will probably get more participants coming as a buyer rather than sellers. As I have stated before, silver has been in consolidation for a very long time, a move outside of the range below could be material. Proper money management is key to trading successfully, along with sound strategy. I would be happy to talk to you about trading ideas in the silver market. The Employment Situation number this morning shows that the fundamentals of the US economy are still solid. The wild card here is the impact of a trade war with China that hasn’t been factored in the market yet. For now, silver seems to be benefiting from it.

Silver Weekly Continuation Chart