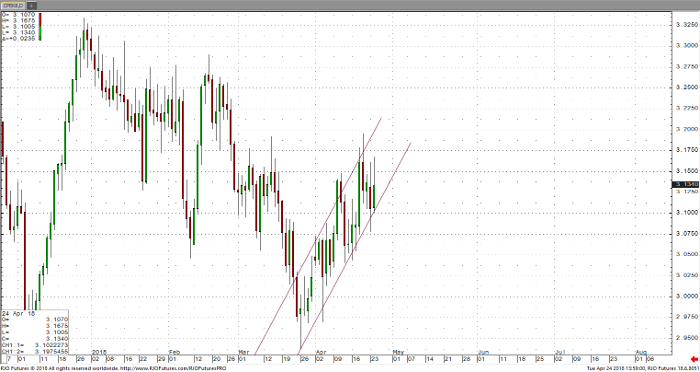

Copper futures bounced off a three-day low, rising 0.0385 or 1.2294%, to 3.17. Copper continues along the uptrend line following the March and April lows as global economic outlook and Chinese demand appear more favorable with recently released data indicating Chinese copper imports went up 5.6% in March from a year earlier. Concerns over protectionist trade policy and the subsequent impact on the demand for raw materials and higher manufacturing costs have weighed on the industrial metal. Treasury Secretary Mnuchin softened discussion on sanctions on Russian metal giant Rusal on Monday while reports of easing Chinese – U.S. trade policy has provided support. The short-term trend is positive with the uptrend line currently serving as support at 3.078 with the next downside target at 3.03. Resistance comes in at 3.15 and 3.19. Prices should continue to post gains for the fifth consecutive week with global economic strength continuing to benefit from strong demand.

Copper May ’18 Daily