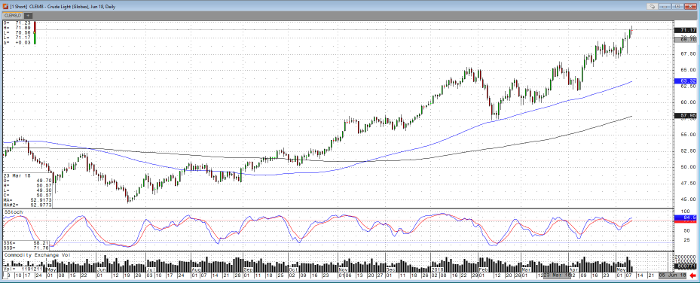

As crude oil trades at the highest level in the front month contract since 2014, a number of factors should be considered. Early in the week there were some comments and speculation that record longs may have been reached again, Friday’s commitment of traders will tell. Tuesday’s Iran announcement saw profit taking and buy the rumor sell the fact trading prior to an EIA report Wednesday which showed a draw in inventories and tighter supply than forecasted with a draw vs. build in inventories, leading to continued strength in the contract. As of Thursday’s open in the western world, the contact has traded from a high of $71.89 before finding support at $70.56, the June is trading at $71.09 as of this writing.

Looking ahead, it is hard to argue with such a strong chart and fundamental factors. However, end of the week profit taking, a crowded trade and corresponding stops, possible mean reversion and overbought conditions should be considered. It will be interesting to see if the strength continues through the end of the week or if the selloff as of this morning continues further. Charts for all time frames above the 5-minute are from the lower left to upper right.

Crude Oil Jun ’18 Daily Chart