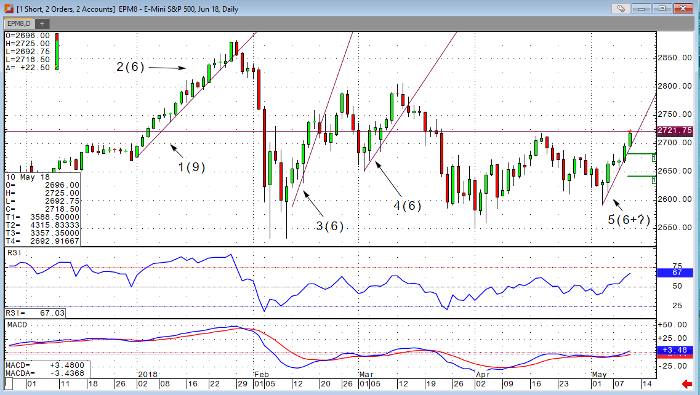

Barring a rather sizable selloff into the closing bell, the E-mini S&P will close higher for the sixth straight session. Since the beginning of the 2018 calendar year, this will mark the fifth time that has happened. Of the previous four, only once did we exceed see a seventh consecutive higher close. That was when we kicked off the year on January 1 and didn’t see a lower close until January 16, ending a streak of nine straight higher closes. Another one of the six days of higher closes resumed began just three sessions and culminated in new all-time highs for the E-mini S&P. That rally was followed by a nearly 1% selloff. Since then, the subsequent rallies have been a bit less dynamic, as were the selloffs that followed. It remains to be seen if this rally will continue, but assuming that we are able to hold at or around these levels into the weekend, we will have bucked the trend line resistance that has tampered all rallies following the selloff from all time highs.

E-mini S&P 500 Jun ’18 Daily Chart