December cotton traded up to 84.89 Monday before coming off its highs and closing at 84.16. Many areas in west Texas saw rain over the past week, but the market pushed higher with bullish support coming from strong demand, and worsening weather conditions with hotter/dryer temperatures forecasted for the next two weeks. China is also seeing declining crop conditions from too much rain and the need for substantial replanting. News over the weekend that the US and China trade negotiations were put on hold with a statement that China would increase purchases from the US gave the cotton market a boost along with other agriculture and energy markets. The weekly planting progress comes in a little higher than last year, but Texas is still behind the 10-year average. The recent rains in west Texas look to not be significant enough to overcome drought conditions and with smaller crops from China, look for the market to remain bullish.

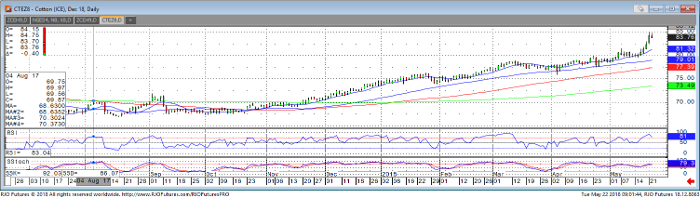

The short-term trend to the upside brought the market again to new highs Monday. Momentum studies are now at overbought levels, which could accelerate a move lower if the market breaks support. Resistance in the December contract comes in at 84.90 and 86.15. First support is around 83.20 and a close below 82.65 would reverse the trend to the downside. Look for the market to try and build some support for a push higher, with possible profit taking up around resistance levels.

Cotton Dec ’18 Daily Chart