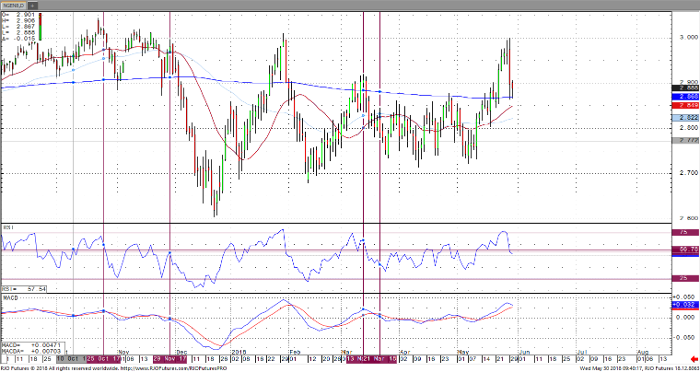

Natural gas is down 0.0310 or 1.0679% today coming off overbought levels continuing further corrective price action after failing to take out the yearly high of 3.010 yesterday. This comes following a temporary top of 3.00 amid the passing of a significant heat wave. Looking ahead, temperatures remain above normal in the western two thirds of the US through the first week of June but shift to cooler than average temperatures through the second week of June on the East Coast and parts of the Midwest. The early projections for Thursday’s EIA inventory report are at a 101 bcf injection in comparison to the 5-year average of 97 bcf injection. Momentum is negative in the near term with resistance at 2.967 and support at 2.834.

Natural Gas Jul ’18 Daily Chart