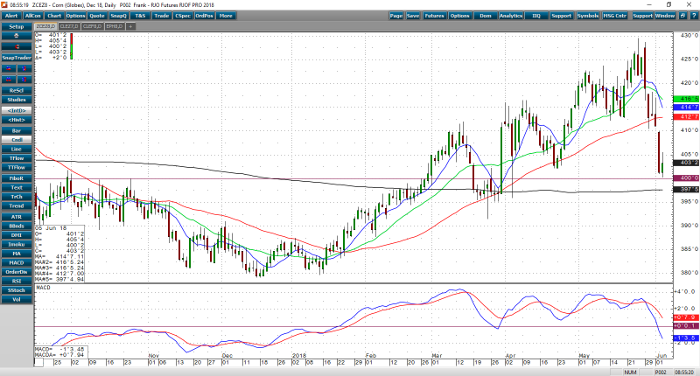

This recent correction in the December corn futures market is likely to be met with buying interest from commercial buyers and from speculative buyers. The December futures have gone from a swing high of $4.29 ½ on May 24 to $4.00 ¼ this morning! Now, the talk of tariffs and trade wars may have weighed on corn prices somewhat, but the real selling pressure has come from the fact that the crop has been planted and thus far weather conditions are pretty good – adequate moisture and heat. For now! So, the crop is off to a good start and current crop conditions are excellent. That’s why prices are down from recent highs.

The 50-day MA for December corn comes in at $3.97 ½ and $4.00 is a big enough level on its own to garner some buying support. More importantly though is the fact that global supplies are tightening, and the US has yet again planted less acreage in 2018. Feed demand is on the rise and our prices are more competitive now. Also, the weather threat is far from over. There is a lot of time for weather premium to build into the price of corn. If we get a dry spell and extreme heat going into the end of July and prices will blow thru that $4.30 level very easily. The chart hasn’t yet given a “buy signal”, however, it’s usually a level on the chart that turns a market around. We’re at that level, I think.

The supply is tight. Acreage has been shrinking and demand is increasing!

Corn Dec ’18 Daily Chart