As crude oil begins to rebound from what some may say was a rash 11.9% drop in price per barrel from the May 22 high of $72.90 to the low of $64.22 on Tuesday, market participants are weighing a number of factors.

While the talk of OPEC producers possibly lifting their supply quota curb to mitigate lost output from Iran and Venezuela joins heavy output from Russia and the United States, there is also the build in yesterday’s EIA report adding to the selling.

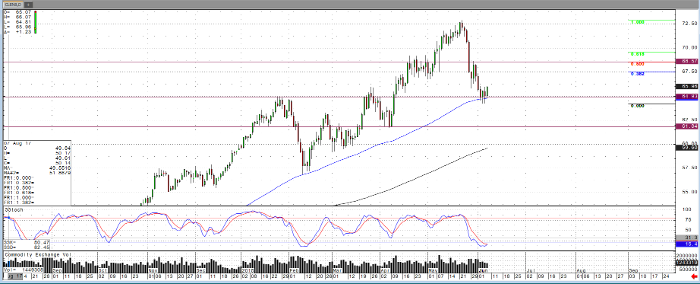

As of Thursday afternoon’s trading and this writing, the July contract has rebounded over a dollar per barrel to just under $66. For those looking for a retracement from the previously mentioned drop, the 50% retracement comes in at $68.57 and coincides with the top of the range from April 19 and May 3’s congestion.

For those looking for continued weakness, although the 100-day moving average has acted support recently, should that level be breached along with this week’s lows, a return to the range pictured below is not out of the question.

To discuss your participation in the oil market and to set up a trading strategy consistent with your objectives, please do not hesitate to contact me at your convenience.

Crude Oil Jul ’18 Daily Chart