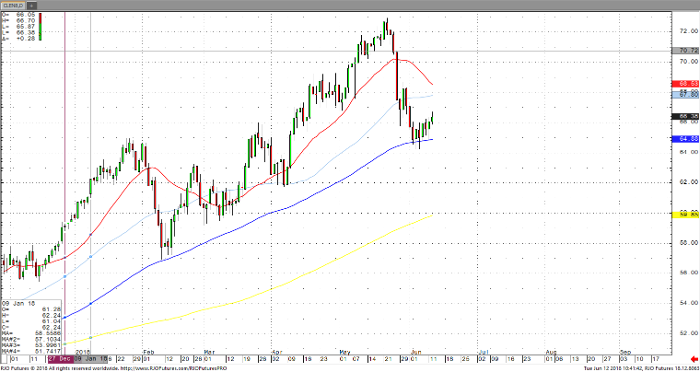

Oil prices are edging higher Tuesday following reports of uncertainty over production among members of OPEC and Russia ahead of their meeting on June 22 in Vienna. OPEC and Russia agreed to cut crude production by approximately 2% last year with the deal expiring at the end of 2018 in order to rein in a global supply glut. Recent reports that several OPEC members are not on board with an increase in production has provided support and sent oil to a weekly high, with the looming threat of loosening production having sent oil prices down to the recent low of 64.22. Saudi Arabia and Russia have expressed willingness to increase supply amid concerns that oil prices have risen too much which has weakened demand and stirred a slowdown in the global economy. Even if OPEC and Russia decide to increase crude output, longer term support would be found from a shrinking of the spare capacity to historic lows, which is the ability of oil producing states to increase production on short notice. Short-term resistance is at 66.82 with the next upside target at 67.35. Near-term support is seen at 65.32 with the next target at 64.34.

Crude Oil Jul ’18 Daily Chart