Overnight Thursday, global equity markets were weaker in the wake of the US FED interest rate hike on Wednesday. However, China posted economic data that grew at a slower pace than anticipated, and the Chinese central bank held steady on interest rates even with the US move to raise rates.

With a fresh four-day low early Thursday, the Fed news from the previous session continues to weigh on prices. However, rumors of additional Us tariffs on Chinese goods and the inability to hold above 2774 in the September E-mini gives the bear camp a fundamental and technical edge today. Fortunately for the bulls, there does not appear to be a high level of concern in place but the net spec and fund long in the E-mini futures possibly recorded another new all-time record high reading and that leaves the market susceptible from a technical perspective. Resistance comes in at 2788 and 2800 with support at 2770 and 2765.

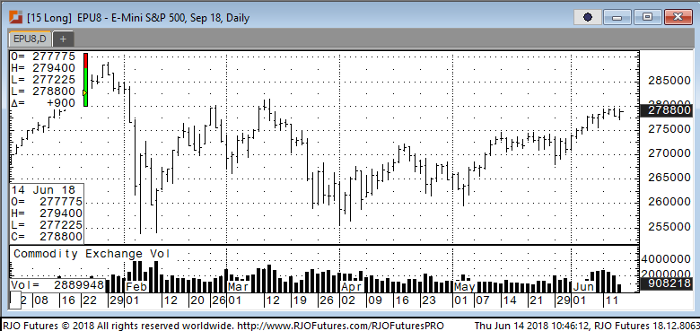

E-mini S&P 500 Sep ’18 Daily Chart