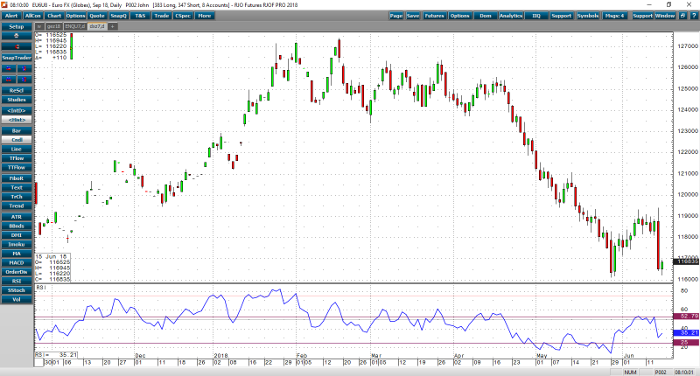

It was an action packed week in the currency space with the FOMC meeting on Wednesday, followed by Mario Draghi and the ECB Policy Announcement. The Federal Reserve raised the overnight lending rate in the United States a 0.25% to 1.75%, while simultaneously signaling more rate hikes to come in near future months. This came as no surprise to market participants as US Growth and Inflation expectations continue to accelerate. The US dollar had a fairly muted reaction (actually finished down for the day), while most of this expected news was likely priced into the market. The big intra-day move in the currency space happened following the much anticipated ECB meeting. Draghi announced an expiration date for the ECBs Quantitative Easing program for December of this year. Furthermore, Draghi mentioned that an ECB interest rate hike could happen as early as midyear 2019. Despite this hawkish portion of policy statement, Draghi also cut the Euro Zones growth forecasts for thru 2020, and upgraded the inflation outlook.

The market reaction was very bearish for the euro vs US dollar pair. The euro sold off to 1.1564 on the June contract, down more 230 points for the day! This appears to be far from over as well. Italy appears to be on the brink of an disastrous debt crisis, seeing interest rates on the Italian 10-yr spike 95 bps in the past month to 2.87%. Where the Euro Zone goes from here, is anybody’s guess, but the slow down doesn’t appear to be over by any stretch of the imagination. The USA still looks good – GDP continues to accelerate, however we are beginning to see early signs of “peak inflation”. The CRB (commodity) Index appears to be posting lower highs, and Treasury bonds are beginning to gain some upside traction. Emerging Markets have crashed in the past several weeks, and China economic conditions appear to be slowing. On top of all of this, the USA appears to be on the brink of a trade war with the rest of the world. From the outside looking in, market on a global scale appears to a slow moving train wreck at the moment. But Shh! Don’t tell equity markets.

Euro Sep ’18 Daily Chart