July silver is holding trading around 16.67 today. The trade is poised to erase all gains from this week. The US dollar once again is firm, and it has taken out three week lows and highs on the chart and closing higher for the week. The dollar is trading at the highest level for 2018. With “tariff” war with China, the dollar has benefited more that than the metals.

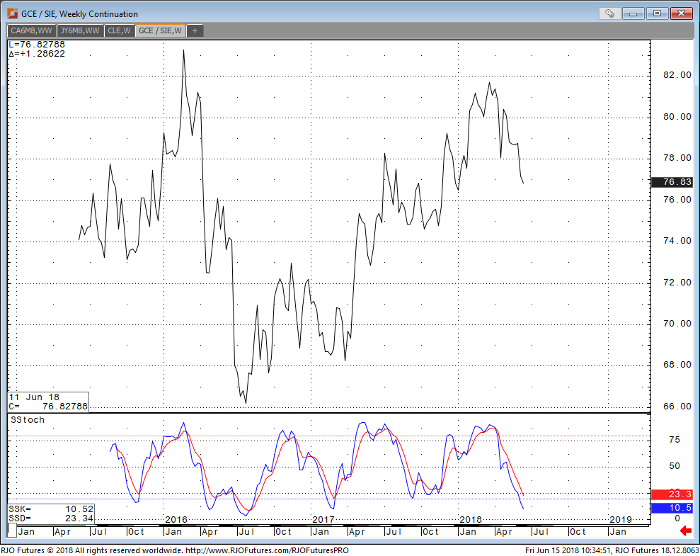

Last month, I wrote about the gold/silver ratio. In it, I discussed how silver is cheaper relative to gold. Gold is still expensive! When I wrote about it last month, the ratio was hovering around 80.00. I stated that above 80.00 makes silver cheap and below 60.00 make gold cheaper from a historical perspective.

Again, the technical outlook for silver is that it is up at least from the monthly low made May 1, 2018 of 16.07. Right now, the weekly chart has a “dark cloud” type of candlestick “in the making” chart formation suggesting that follow-through weakness is possible. But the trading day is not over yet. Silver has a lot of support around 16.00. I would not throw in the towel so to speak on the bull scenario until I see a close below 16.00.

All that said, a close above 17.00 is needed to complete corrective price action. If you like to discuss trading ideas around these levels, please reach out to me. Otherwise, happy trading!

Gold/Silver Ratio Weekly Chart