As of Thursday morning, the crude oil market is justifiably middling with trading near the top of today’s range so far and in the lower half of yesterday’s. Given yesterday’s EIA number and this weekend’s upcoming OPEC and OPEC+ meetings, this is understandable.

This week’s EIA had a draw of 5.9 million barrels compared to a previous draw of 4.2 million barrels and the consensus estimates for a draw in the area of 2.5-2.9 million barrels. While this was a larger than expected draw and there was some positive price action following the number, this was not without some volatility and the market anticipating the upcoming OPEC and OPEC+ meeting in Vienna at the end of this week.

Regarding the Vienna meeting, many are looking for an easing of the production quota to mitigate lost production from Venezuela as well as impending sanctions on Iran. While an increase may be possible, the question will be how much and whether the market views this as an increase or making up for lost production.

There are also a number of conflicting objectives between the nations involved. This presents uncertainty given the difference between OPEC needing to be in accordance whereas OPEC+ and its non-OPEC members free to do as they may please.

An interesting development is the Saudi Energy minister beginning with a suggestion for a 1 million barrel per day increase in output as a starting point, a view unlikely to be shared by Iran. While betting ahead of such a meeting seems foolish, there are ways to position for volatility regardless of the outcome.

To discuss how to position your account in the oil market and others, please contact me at your convenience.

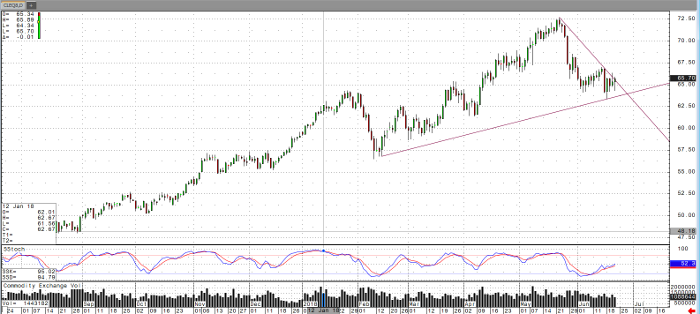

Crude Oil Aug ’18 Daily Chart