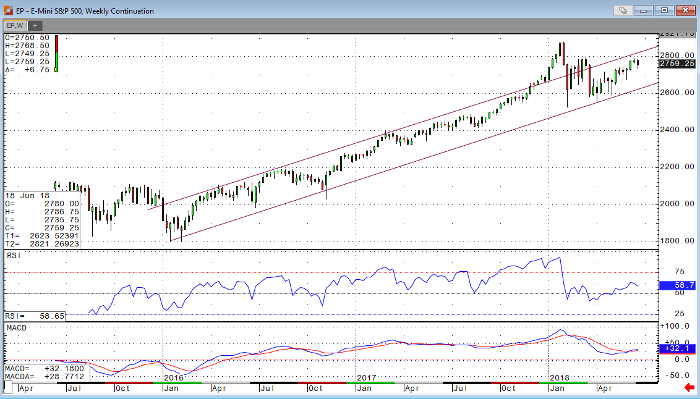

Stock indices are higher shortly after this morning’s open. The S&P and Dow have kicked the morning off in the green by a decent amount, while the Nasdaq is struggling a bit (Likely due in large part to the online sales tax ruling handed down by the Supreme Court this week). The Nasdaq and S&P are near the upper end of the trading channel we’ve spent the majority of the last two and a half years trading in, while the Dow appears to be on the lower end of its channel. Given the threats of tariffs that are hanging over the markets, I would argue the action over the past week or so is rather impressive. Should we find some middle ground before the tariffs are set to go into effect early next week, I believe we could see some sizeable rallies. Barring some compromise, we may struggle to build on the upward momentum as the second quarter comes to a close. Today’s news cycle is very light, but next week’s data could very well provide the market with some fuel for the next move higher or lower. Housing data, consumer confidence and sentiment, and GDP will be the numbers I’ll be watching closest.

E-mini S&P 500 Weekly Chart