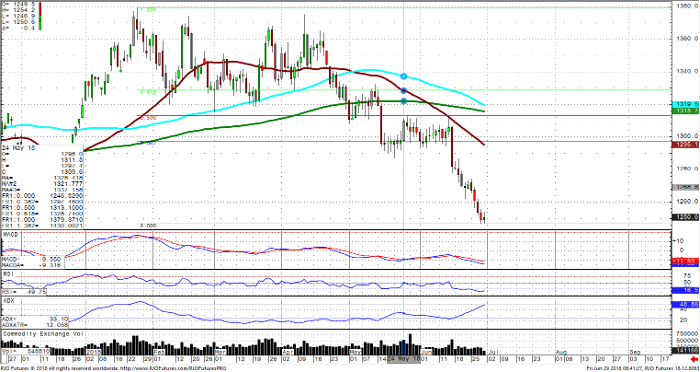

Currently, August gold is trading around the July 2017 low range at 1250. I would expect gold to remain under pressure as the recent economic data around the world (mostly positive numbers) coupled with a much weaker USD has gold only marginally higher. The US equity markets have seemed to have found their footing once more and a push back to 2800 on the September ES is a possibility. A fundamental look at gold shows that without more geopolitical tension, buying interest from India and China, a weaker USD, and a full-blown trade war with China it’s likely that gold remains under pressure. Chart damage has been done in great lengths with the recent selloff below 1250. It’s clear that a trade war with China would have negative ramifications for precious metals and industrial metals as more reason to be bearish. It should also be noted that the gold ETF’s out there are sitting at almost 3-month lows in long positions. Investors are clearly worried gold has more room to slide.

If you look how gold futures trade, a full contract is 100 oz. You could also trade the ICE mini contract of 50 oz and the COMEX 33oz contract as alternatives for trading the full contract. With the recent volatility in gold picking up it might be best to look at a smaller futures contract, or options trades for more conservative investors. On a technical level we really need to see closes above $1275 before any hint of being a longer-term bull can be justified. The levels to watch for pivot points to the upside are 1300, 1313, and 1330. These are Fibonacci retracement levels that are important to watch. Look for a washout down to the July 2017 lows before any support is found.

Gold Aug ’18 Daily Chart