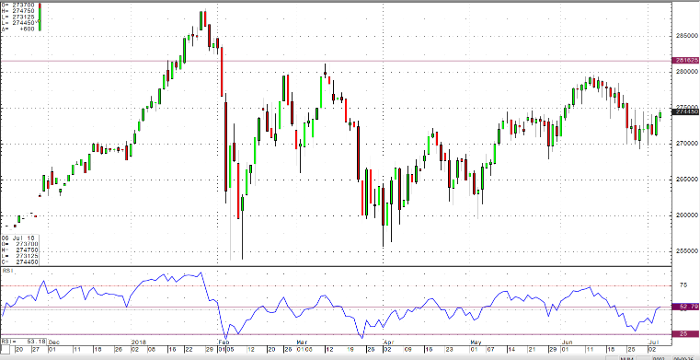

This morning’s jobs data showed an added 213,000 jobs. Consensus had the number pegged at 190,000. We also saw a revision to the June number of an additional 21,000, bringing that number up to 244,000. On the other hand, we were expecting to see the unemployment rate hold steady at 3.8%. That number rose up to four percent unfortunately. An additional half a million unemployed people looking for a job was the main contributor there, which also raised the participation rate by 0.2%. The net effect on the market so far has been a nice bump from the levels we saw when the data was released.

The chart action appears constructive, but I think lack of any compromise on the tariff situation(s) is keeping a bit of a lid on the market for the time being. The tariffs were set to go into effect today, and I was under the impression the market was remaining afloat on hopes of some kind of compromise in regard to the situation. So far, it seems that the other parties involved are still preparing retaliatory tariffs rather than trying to reach an agreement on trade. The market seems to be shrugging this off as posturing for the time being. We will continue to monitor news over the weekend to see how this plays out.

E-mini S&P 500 Sep ’18 Daily Chart